Introduction

1. The claimant was the owner of premises comprising a former amusement arcade with residential accommodation above at 25 - 26 West Parade, Rhyl, LL18 1HF (“the property”) which were acquired by the respondent on 26 November 2013 (“the valuation date”) by a compulsory purchase order made under the West Rhyl Regeneration Strategy. This reference has been brought to determine the compensation payable to the claimant for the acquisition of the property.

2. The property had been severely damaged by fire in February 1993 and remained in its damaged state at the date of acquisition almost 20 years later. Planning permission had been granted in December 1993 for the restoration of the property as an amusement arcade and food kiosk with eight self-contained flats above but it had never been implemented. The permission had long since lapsed, but it was agreed by the parties that the same permission would have been available at the date of acquisition and should be assumed for the assessment of compensation.

3. The matter in dispute is the market value of the property for compensation, assessed under section 5 of the Land Compensation Act 1961 (“the 1961 Act”). A scarcity of good comparable evidence led the valuation experts to adopt both the comparative and residual methods of valuation. The latter raised significant differences over whether refurbishment, rather than redevelopment, was feasible and over the approach to assessing costs.

4. The hearing of the reference was conducted by remote video platform. Mr Daniel Dovar appeared for the claimant, and Mr Emyr Jones for the respondent. Expert evidence on building costs was given by Mr Richard Owen of Rowen Ltd and by Mr Stephen Jones MRICS of the Valuation Office Agency. Expert valuation evidence was given by Mr Gavin Floyd FRICS of Deesurveys Limited and by Ms Lisa Bryan MRICS of the District Valuer Service. Both parties also relied on the evidence of a number of witnesses of fact to whom we will refer.

The property and its acquisition

5. West Rhyl is one of the most deprived areas in Wales but at the valuation date West Parade was characterised by leisure, retail, restaurant and commercial uses. The respondent had resolved to implement a regeneration strategy in 2002 and by November 2013 redevelopment of visitor attractions and leisure facilities was in progress.

6. The property was formed by the amalgamation at ground floor level of two adjoining properties, 25 and 26 West Parade, within a brick built three storey Victorian terrace (21 to 37) on Rhyl’s long seafront. A two-storey extension to the rear of the properties opened onto a narrow service road, shared with 24 and 27, which gave access to Crescent Road. The property had no parking area but a public car park was sited close by on Crescent Road.

7. The site area was agreed to be 308 square metres (3,315 square feet).

8. Mr Duncan Newport, a director of the claimant since February 2020, gave evidence about his personal involvement with the property over many years. He took a lease of the property in 1990 when, photographs show, the ground floors of 25 and 26 were separately occupied by leisure businesses. Mr Newport redeveloped it to create a large open plan amusement arcade in the combined ground floor of 25 and 26, with accommodation and storage on the first and second floors. At some point in 1992 he acquired the freehold interest in the property.

9. On 4 February 1993 the upper floors of the property suffered severe damage from a fire, which broke out in the top floor of 26, spreading into 25 and also into the neighbouring 27. Photographs from that time show that the roof structure collapsed entirely into the upper floors of the building, leaving partition and exterior walls exposed at second floor level. Structural damage occurred to the interior of the property at second and first floor level, but the extent and implications of the damage were disputed between the parties.

10. A scheme for refurbishment had been drawn up by Lawray architects and surveyors, with the cost of the scheme estimated in May 1993 at £341,900 plus VAT. Drawings dated October 1993 (“the Lawray drawings”) show an amusement arcade on the ground floor and nine one-bedroom flats over three upper floors, including a new attic conversion and additional floor above the rear extension. Planning consent was approved on 8 December 1993 for the arcade and eight one-bedroom flats, reduced from nine by limiting the height of the rear extension to three floors.

11. The floor areas taken from the Lawray drawings, agreed by the parties, would provide a total of 864 sq m gross internal area comprising 308 sq m at ground floor, 207 sq m at first floor, 207 sq m at second floor and 142 sq m at third floor. As originally drawn they provided for the third floor to be the same size as the second and first floors, at 207 sq m, giving a total of 929 sq m as costed in May 1993.It was originally anticipated that the refurbishment would take place with the aid of a grant from the Welsh Development Agency, secured with the support of Rhuddlan Borough Council. A valuation dated 21 February 1995 provided by Countrywide Surveyors valued the property in its existing condition at £150,000 with an estimate of the value on completion at £350,000. The valuation assumed that grant aid of £150,000 would be available. In the event no grant materialised following local authority restructuring and transfer of functions to the respondent. It was apparent that Mr Newport was seriously aggrieved by the claimant’s inability to obtain grant funding and that he felt he had been misled by the respondent’s predecessor authority. Whether his sense of grievance is justified or not is not the subject of this reference, but the absence of public funding helps to explain in part why the property remained derelict for so many years. Mr Gerald Thomas, the respondent’s Valuation and Estates Manager from 2012 to 2020 gave evidence that since 2008 private investment could not be attracted to Rhyl without the Council’s financial support.

12. The property remained in its open and damaged state for over 20 years before the valuation date. Only minimal precautions seem to have been taken to protect it from the elements. A cement cap was placed along the top of the newly exposed front wall at second floor level in 1993. In around 2005, the upper front wall was lowered down to first floor level as a safety precaution but no further capping took place at that time and the top of the wall became exposed.

13. Adjoining the property at 21 - 24 West Parade, were the premises of a night club known as the Honey Club (extending to a gross internal area of 1,732 sq m, excluding the ground floor of 24 which was occupied separately). In 2009 or 2010 the Honey Club was advertised for sale with a guide price of £700,000. It was in a dilapidated state and failed to sell. A liquidator was appointed and the Honey Club premises were subsequently offered for sale by auction with a guide price of £200,000 to £300,000. On 10 December 2010 the respondent acquired the Honey Club by agreement with the liquidator, ahead of the auction, for £249,995.

14. The purchase of the Honey Club was the first step in implementing the respondent’s emerging Rhyl Going Forward Delivery Plan. The Plan identified the whole terrace, from 24 - 37 West Parade, as a priority intervention area and the property was named as one of Rhyl’s “eyesores” for which a strategy for improvement would be developed.

15. In March 2011 the respondent commissioned the District Valuer to prepare a valuation report on the property with a view to acquisition. The property was valued at £75,000, as at 28 March 2011, assuming that planning consent would be available for retail use on the ground floor and self-contained residential accommodation above.

16. The ground floor of 24 had remained in separate ownership and was occupied by the Rock Shop and Tattoo Parlour. On 8 December 2011 the respondent acquired it for £240,000. Mr Gerald Thomas, valuation and estates manager for the respondent, gave evidence explaining that it was an urgent purchase on health and safety grounds because of the dilapidated and unsound condition of the upper floors of the Honey Club premises above, which by then were owned by the respondent.

17. The Honey Club (and ground floor of 24) was demolished in the summer of 2013, following delays due to the conservation officer objecting to demolition of a building in a designated conservation area.

18. The Denbighshire County Council (25 and 26 West Parade, Rhyl and Nearby Access Roads) Compulsory Purchase Order 2012 was made on 30 July 2012, and confirmed by the Welsh Ministers on 13 August 2013, authorising compulsory acquisition of the property for the purpose of improvement and redevelopment.

19. Subsequent negotiations for acquisition of the property by agreement failed and the respondent acquired title by a general vesting declaration dated 26 November 2013. This is agreed to be the date of acquisition and valuation.

20. Since the compulsory acquisition of the property it has been comprehensively redeveloped, along with the site of the Honey Club, and it is now a hotel.

Statutory provisions for assessment of compensation

21. Section 5 of the Land Compensation Act 1961 (“the 1961 Act”) sets out the rules for assessing compensation, of which the relevant rules at the valuation date were:

“(1) No allowance shall be made on account of the acquisition being compulsory:

(2) The value of land shall, subject as hereinafter provided, be taken to be the amount which the land if sold in the open market by a willing seller might be expected to realise:

…

(6) The provisions of rule (2) shall not affect the assessment of compensation for disturbance or any other matter not directly based on the value of land.”

22. It was agreed by the parties that under section 14 of the 1961 Act, as amended by the Localism Act 2011, the planning permission granted in December 1993 should be assumed to have been available on the valuation date for the purpose of valuation under rule (2).

The issues

23. The disputed compensation amount is the market value assessed under rule (2).

24. The claimant’s valuation expert, Mr Floyd, assessed the market value using both the residual method for a site with planning consent and the comparative method for a cleared site. He valued the property using the residual method at £929,000 and using the comparative method at £300,000. He stated in his oral evidence that he considered the market value of the property on the valuation date to have been the higher of these figures.

25. The respondent’s valuation expert, Ms Bryan, assessed the market value using the residual method at between -£618,234 and -£936,219, depending on the assumptions used. Using the comparative method she assessed the market value at £60,000 and considered that was the appropriate value to use for compensation.

26. The difference between the values achieved using the comparative method arose from the respective approaches to selection and analysis of comparable evidence, which will be reviewed later in this decision. Witness evidence of offers which the claimant had received to buy and to lease the property will also be reviewed.

27. The vast difference between the figures assessed by each valuer when adopting the residual method arose essentially from disagreement on three components of the valuation calculation: the cost of redevelopment (or refurbishment), the investment value of the amusement arcade in the ground floor, and the potential annual income from the eight self-contained one-bedroom flats on the assumption they would be used for holiday lets. Some of the subsidiary components in the respective residual calculations had been agreed, which was helpful. Differences in the assessment of the investment value of the ground floor rested on selection and analysis of comparable evidence. Differences in the assessment of income from holiday lettings arose from reliance on the advice of different specialists in holiday lettings, who were not called to give evidence, and from alternative interpretations of published survey data on occupation rates for holiday lets in Wales. More will be said about these differences later.

28. Each party had instructed an expert in building costs and the respective valuation experts simply adopted the estimate of total building cost provided by their instructing party’s expert. That was a disappointing and unhelpful approach for experts in one discipline to take to the range of views expressed by experts in a different discipline. It suggests a lack of objectivity and a misunderstanding of the expert’s function. It effectively precluded Mr Floyd and Ms Bryan from any meaningful narrowing of their valuation difference. The Tribunal’s case management directions had provided for sufficient time (one month) between the filing of expert evidence on building costs and on valuation, and it was the duty of the valuation experts to recognise that the Tribunal might not accept the evidence of their team mate and to consider the market value of the property having regard to the range of evidence presented.

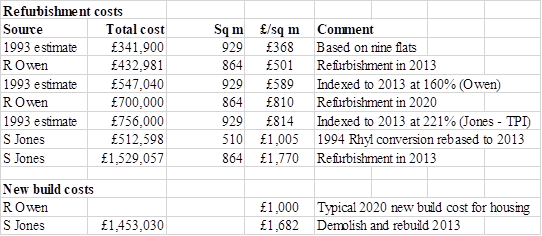

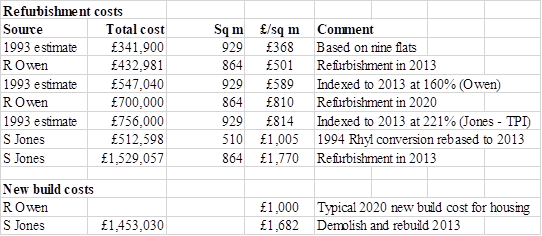

29. The claimant’s building cost expert, Mr Owen, assessed a total cost of £432,981 (£501 per sq m overall), on a component basis, for rebuilding the property (without demolition) to the specification in the Lawray drawings. Mr Owen relied heavily on his own personal experience of pricing work for contractors in North Wales. The respondent’s building cost expert, Mr Jones, assessed a total cost on the basis of floor areas and a range of figures derived from the Building Cost Information Service (“BCIS”). His assessment of the cost for a refurbishment and extension of the existing structure was £1,529,057 (rounded at £1,770 per sq m) and on the basis of demolition and rebuild was £1,453,030 (rounded at £1,682 per sq m).

30. Neither of the building cost experts had seen the property in its damaged state before redevelopment, so a subsidiary issue concerned its condition and structural integrity at the valuation date, more than 20 years after the fire damage occurred. The claimant relied on evidence from Mr Duncan Newport and his father Mr Rex Newport, both of whom had personal knowledge of the building from the time of the fire. The respondent relied on evidence from Mr John Evans of Evans Wolfenden Partnership (“EWP”), a chartered civil and structural engineer who had been instructed to report to the respondent in 2011 on the condition of the Honey Club, including the party wall it shared with the property. The respondent also relied on evidence from Mr Mark Chapman of Capita Property & Infrastructure Ltd, a chartered building surveyor, who had been instructed in 2011 to represent it in party wall matters arising from the proposed demolition of the Honey Club.

31. We will review the factual evidence on the structural integrity of the property at the valuation date followed by the expert evidence on building costs. We will then turn to evidence of offers received by the claimant and conclude with the expert evidence on valuation.

The factual evidence on structural integrity

32. Mr Evans inspected the Honey Club and its party wall with the property in April and May 2011, and his EWP report on 25th May 2011 stated that the Honey Club was in a seriously dilapidated and potentially dangerous condition. The report recommended demolition, rather than refurbishment, and that this would necessitate either temporary support and extensive repair, or demolition, of the party wall with the property. It also recommended action to take control of the separately owned ground floor of 24, which was at risk from any works to the upper floors.

33. Mr Chapman’s evidence was that he inspected the property in July 2011 and prepared the Capita report for the respondent dated 21 July 2011. This confirmed that the wall between 24 and the property was a party wall, so demolition of the Honey Club would require the Party Wall Act 1996 to be followed. Mr Chapman was then instructed to act for the respondent under the 1996 Act and in August 2011 carried out a photographic survey of the property from a crane basket. These photographs were very helpful and provided the only evidence of the internal condition of the property ahead of the valuation date.

34. On 5 September 2011 Mr Chapman issued a notice informing the claimant of the respondent’s intention to demolish the party wall. The claimant appointed Mr Scott as its party wall surveyor and the two surveyors agreed a joint party wall award on 10 May 2012. The party wall award included an indicative plan (due to restricted access inside the property) of internal walls and structures which would be demolished if necessary in order to carry out demolition of the Honey Club in a safe manner.

35. Demolition of the Honey Club was delayed due to objections from the respondent’s conservation officer and Mr Evans was instructed to re-inspect Honey Club and the property in January 2013. He reported that the property was in a dangerous condition and that demolition of the party wall was likely to result in collapse of the main structure, which he recommended should also be demolished. In cross examination Mr Evans explained that he had not been able to inspect the ground floor of the property and had made assumptions as to the internal condition.

36. Mr Duncan Newport’s evidence was that he had inspected the property in early 2013 and observed that the only work required to keep the building safe was some remedial work to the exposed party wall gables and demolition of some non-structural internal walls. He stated that the party wall award had been signed without the authority of the claimant, albeit by their appointed agent, and pointed out that notwithstanding provision for parts of the property to be demolished if necessary, demolition of the Honey Club took place in mid-2013 without any associated demolition of the property. A newspaper photograph from the time showed the rear extension and party walls of the property, adjacent to the bare site of the demolished Honey Club, unsupported and without protection to passing pedestrians. Another photograph, taken after demolition of the property, showed the party wall to 27 unsupported and without safety measures, indicating that it had been a sound and significant part of the property prior to its demolition.

37. Mr Rex Newport, father of Mr Duncan Newport, was also very familiar with the property. He gave evidence that he had inspected the property twice in early 2013, internally and externally, and formed the impression that all walls, the ground floor slab and supporting pillars were in a safe condition to enable redevelopment without further engineering support.

Expert evidence on the cost of refurbishment or redevelopment

Evidence for the claimant

38. Mr Richard Owen has worked in the building industry in North Wales for 24 years, including 20 years as a quantity surveyor for the Watkins Jones Group before establishing his own company, Rowen Limited, which provides commercial support, project management and build cost estimating to contractors. He was instructed by the claimant to consider the evidence concerning the condition of the property and provide a schedule of costs to rebuild the property to the specification in the Lawray plans. Mr Owen had not given expert evidence before and acknowledged that he was not fully aware of the duty of an expert witness to the Tribunal. Nevertheless, he had a great deal of relevant experience and he was clearly doing his best to assist the Tribunal by giving straightforward and unvarnished evidence of how he would have priced the necessary work.

39. In his opinion the main structural load bearing walls of the property, including the three party walls, were in a satisfactory condition for use in the redevelopment. He had assumed that the ground floor steelwork, which had remained encased in plaster board, was undamaged following the fire and could be reused. Two RSJs in the second floor of 26 were damaged and he had allowed for their replacement. Whilst noting the contents of reports by EWP and Capita, Mr Owen concluded that, since the respondent had not taken the precautionary actions recommended in those reports, the structural integrity of the property had been proved to be sufficient for it not to require demolition.

40. Mr Owen’s assessment of the build and fitting out cost was based on a detailed analysis of itemised materials and labour costs using figures relevant to 2013/14, with a number of provisional sums, totalling £432,981.36 before VAT. We note that the schedule in his report of 13 September 2020 was based on a total floor area of 755.61 sq m (giving a rate of £573/sq m) and that Mr Owen subsequently agreed the total gross internal area to be 864 sq m, with no adjustment to the overall cost estimate which reduced the unit cost to £501/sq m.

41. In the joint statement of the building cost experts Mr Owen provided three further comments as context for his figure by comparison with that provided by Mr Jones. First that the build cost estimate of £341,900 provided in May 1993, for nine flats and an extra floor at the rear of the property (so a greater floor area than in the planning permission), could be adjusted by 3% per annum for 20 years (taken at a 60% uplift) to give an equivalent cost in 2013 of £547,040 (£633/sq m). Second, it was his opinion from his current experience of actual build costs, that the cost of the works in 2020 would be no more than £700,000. Third, that in his experience cost estimates in 2020 for new housing construction in North Wales were at levels between £950/sq m and £1,050/sq m.

42. In cross examination Mr Owen admitted that his use of 3% per annum was not based on any published index of building cost inflation. He agreed that it would be better to use the tender price index (“TPI”) published by BCIS, but this was a subscription service not available to him. It was put to him that the relevant index figures for the second quarter of 1993 and fourth quarter of 2013 were 108 and 239 respectively, giving an uplift factor of 2.21 over the period and an equivalent figure of £756,000 (subsequently confirmed in Mr Jones’s oral evidence). Regarding the cost figure of around £1,000/sq m for new housing, he acknowledged that this was a price paid direct to a building contractor such as Watkins Jones, and would not include professional fees or profit for the site owner as developer.

Evidence for the respondent

43. Mr Stephen Jones is a chartered building surveyor who has worked for over 30 years in the construction industry, including in private practice and local authority work before he joined the Valuation Office in 2017. His experience includes preparing budget estimates for capital programmes and administering refurbishment and new build contracts. He was instructed by the respondent to provide an assessment of the condition of the property at the valuation date and, based on that assessment, an estimate of the cost of developing the property in accordance with the Lawray drawings and the planning permission.

44. The information used by Mr Jones to assess condition included the reports, photographs and party wall award commissioned by the respondent, as described in the previous section, but not the evidence of Mr Duncan Newport or Mr Rex Newport. He provided costs from the BCIS database on the basis of either refurbishment and conversion or, in the alternative, demolition and reinstatement. The database has built-in adjustments available for specified dates and locations.

45. In assessing the cost of refurbishment and extension, Mr Jones used gross internal areas of 527 sq m for the area to be refurbished and 337 sq m for the area of new work providing a third floor to the rear and residential accommodation in the attic. The unit (per sq m) costs of three case study refurbishment projects selected by him from BCIS data were £1,271, £1,814 and £3,806 giving an average of £2,297. Mr Jones took the median figure of £1,814, the average of £2,297 and averaged those with a third figure of £1,786 based on a BCIS average construction costs for housing with shops, offices and workshops to get a unit cost of £1,966 per sq m. He adjusted this down to £1,885, reflecting a lower contribution of external works at the property, giving an overall cost on 527 sq m of £993,181. To this he added £410,982 (£1,220/sq m) for the cost of new (extension) work and £124,894 (£145/sq m) for additional work to the party walls with 24 and 27.

46. Mr Jones’s final cost assessment for refurbishment and extension was £1,529,057 (£1,770/sq m). In cross examination he acknowledged that two of the three case studies chosen were listed buildings, unlike the property, and that the floor areas of all of them, ranging from 162 sq m to 288 sq m, were much smaller than the property, rendering them not useful as comparables. Mr Jones defended inclusion of the 162 sq m case study, at a cost of £3,806/sq m, on the basis that it balanced out a low figure of £1,271/sq m at the other extreme. It was put to him that the low figure, for a case study of a fire damaged property, was actually the most appropriate. Moreover, once an apparent error in the calculations had been corrected, this figure was reduced to £1,105/sq m.

47. When cross examined on the figures underlying the £410,982 attributed to new work, Mr Jones acknowledged that his datasheets, taken from a BCIS programme, seemed to include further errors and anomalies, and possibly even some duplication of overheads shared with the refurbishment part of the scheme.

48. In Mr Jones’s alternative basis of cost assessment, assuming demolition and reinstatement, a similar approach was used, combining two averages of case study properties with an overall BCIS average to get a figure of £1,453,030 (£1,682 per sq m). Similar anomalies, and inconsistencies were revealed, most notably, the inclusion of a case study from prime Central London.

49. Finally, as a cross check to illustrate the cost of refurbishment of an extant structure, Mr Jones reviewed a BCIS case study from 1994 of a conversion in Butterton Road, West End, Rhyl where four storey housing of 510 sq m was converted into nine flats. The cost shown in the BCIS print out, after rebasing to late 2013 using the function built in to the database, was £1,005 per sq m. Details of the calculations used to rebase the figure could not be provided.

Discussion

50. We are unable to accept the evidence of either expert as a wholly reliable guide to the likely costs of redevelopment of the property. Although Mr Owen was not properly instructed in giving expert evidence, we found his approach to the costing exercise and his answers in cross examination to be persuasive and well considered, but he relied heavily on the evidence of the claimant’s directors in regard to the condition of the property at the valuation date and provided no figures assuming it would have been necessary to rebuild the property entirely.

51. Mr Jones’s view of the condition of the property was based on the reports provided to the respondent in the run up to the valuation date. These were professional reports, written by qualified engineers and surveyors, but inevitably they had a heed to the possible consequences, to themselves and the respondent, of under estimating risk and the potential liability arising from the damaged condition of the property.

52. It is not disputed that when demolishing the Honey Club the respondent took none of the actions recommended in the party wall award. We assume that the contractors appointed to carry out the work and the engineers who supervised it took a less pessimistic view of the risks than Mr Evans and Mr Chapman, and that, whether by luck or better judgment, they were proved right. We conclude that, perhaps surprisingly, the structural integrity of the property was not as badly compromised by the fire damage and subsequent 20 years of exposure as might have been expected.

53. Whether a large cost saving could have been achieved in a redevelopment project is still a moot point. Mr Jones proposed that the costs associated with refurbishment would be greater than those for demolition and rebuilding. But for the reasons we have already indicated we cannot rely on the figures which Mr Jones produced. His selection and deployment of BCIS data was erratic and unconvincing, as was demonstrated in cross examination. None of the projects he drew on as examples appeared to us to be a particularly good fit for the redevelopment of the property. In general, the way Mr Jones averaged and manipulated the data gave us no confidence that the end product was a reasonable reflection of the likely costs.

54. The figures produced by Mr Owen include provisional sums for many unknowns and, as they were based on a specification drawn up in 1993, they may not take full account of the higher specifications required by building regulations at the valuation date 20 years later. They were provided by Mr Owen in good faith, but they seem very optimistic and set at a level where a cautious developer would need to build in many contingencies for risk. We also bear in mind, that whatever form the development of the property took, it is likely that it would have depended on commercial funding and that a bank or other lender would have required reassurance that the finished product would be free of any doubt over its structural integrity. We think it likely that a structural engineer or building surveyor advising a lender would have been inclined to take a cautious approach and that if the relative cost of refurbishment and extension on the one hand, or demolition and reconstruction on the other was marginal, the likelihood is that the more comprehensive approach would have been insisted on.

55. The various figures in evidence before us for the costs of refurbishment or new build are summarised below in ascending order of unit cost:

56. The original 1993 cost estimate, at £341,900 was equivalent to £368/sq m for a floor area only 7.5% more than the eventual consented development, so close enough in scale not to affect the unit rate. We assume that it was considered by the claimants to be competitive since it was made available for the secured lending valuation in February 1995. The TPI figures from BCIS are a sound basis for adjustment, albeit over a very long period, and we consider that the adjusted figure of £814/sq m would reflect the minimum cost of refurbishment in 2013, before allowance for higher building regulations specifications in 2013 and deterioration of the property over the 20 year period.

57. We had no evidence before us intended to assist with these adjustments. For the reasons we have given we do not think the cheapest form of development would necessarily have been preferred and, doing the best we can, we add 25% to £814/sq ft to arrive at a unit cost of £1,018/sq ft which we shall round down to £1,000/sq ft giving a total cost of £864,000.

Evidence of offers received by the claimant

58. Mr Mark Tilsley was the sole director of the claimant from October 2003 until February 2020. He gave evidence of an offer to purchase the property for £350,000, made on 7 October 2011 by Dr Krishna Reddy, the director of a property development company. Dr Reddy gave written evidence of this offer and explained in oral evidence that his company specialised in providing temporary accommodation for homeless offenders when released from prison. In 2011 a nightly rate of £40 was paid by Preston City Council for single bedroom accommodation and budgets were based on that level of income. Dr Reddy said he had intended to develop the ground floor of the property as a restaurant and eventually to benefit from the expected rise in property values as the regeneration of Rhyl took effect. Mr Tilsley stated that Dr Reddy’s offer had been rejected by the claimant as too low.

59. Mr Tilsley also gave evidence of terms agreed with Mr Charles Wright in early 2013, subject to contract, for a 25 year lease from February 2014 at a rent of £45,000 per annum of what was proposed to be a refurbished amusement arcade on the ground floor of the property. The terms included the tenant fitting out, as an amusement arcade and food kiosk, and insuring the ground floor premises. Mr Duncan Newport had known Mr Wright for many years as a successful operator of businesses in Wales and the north west of England. They had had previous discussions in 2001-2002 regarding a similar proposition. Mr Wright provided written evidence to confirm that he had agreed those terms, subject to contract, but stated that he did not realise at that stage that a compulsory purchase of the property had already been proposed by the respondent.

60. In cross-examination Mr Tilsley agreed that the claimant was dormant at the time of both the 2011 offer from Dr Reddy and the agreement in principle with Mr Wright and had taken no direct actions of its own to progress any development scheme for the property.

Expert evidence on value

Evidence for the claimant

61. Mr Gavin Floyd FRICS has over 36 years’ experience in general practice and is based in Chester where he is managing director of Dee Surveys Ltd. Mr Floyd was instructed by the claimant in July 2019 to represent it in negotiations over compulsory purchase compensation with the respondent. He produced a report on 15 October 2020 on the market value of the property at the valuation date which was used by the claimant in those negotiations. He produced further reports dated 15 December 2020, 7 January 2021 and 15 January 2021, and agreed a joint statement with Ms Bryan on15 January 2021.

62. Mr Floyd’s preferred approach was the residual method of valuation taking into account the planning permissions assumed to be available. This required assessment of the gross development value (“GDV”) of the two components of the development: first the investment value of the ground floor let as an amusement arcade and food kiosk; second the investment value of eight one-bedroom holiday apartments on the upper floors.

63. Mr Floyd assessed the gross rental value of the ground floor at £52,800 or £17.21/sq ft for 3,068 sq ft of net internal area (“NIA”). He achieved this figure by analysis of a rent of £18,850 paid at 16 High Street, Rhyl for ground and first floor retail accommodation of 1,460 sq ft. He halved back the area of the first floor to get a net effective area of 1,095 sq ft and an adjusted rent of £17.21/sq ft. Mr Floyd’s opinion was that this level of rent was underpinned by the offer of £45,000 made by Mr Wright and also by analysis of the letting of the un-refurbished ground floor of neighbouring 27 for £15,000. That letting was to the former occupier of the ground floor of 24, purchased in December 2011 by the respondent. Assuming that 27 had the same floor area as each of 25 and 26, Mr Floyd doubled the rent of £15,000 to £30,000 and added 50% more to reflect the refurbished state of the property to achieve a rent of £45,000.

64. Mr Floyd deducted 10% from his gross rent of £52,800 for management costs, to get a net rent of £47,520, which he capitalised at a yield of 9.2% to an investment value of £516,542 (a typographical error which should have read £516,524, but we will use his figure). The yield was, again, derived from the evidence of 16 High Street, Rhyl which was sold in October 2012 to the occupier for £230,000, reflecting a yield of 8.2% on the passing rent of £18,850 (see above). Mr Floyd adjusted that yield up by 1% to 9.2%, to reflect an investment yield rather than a purchase to vacant possession.

65. The GDV of the eight holiday apartments was assessed by Mr Floyd at £1,355,000, reflecting net income of £108,400 (a typographical error which should have read £108,040, but we will use his figure) capitalised at the yield of 8% agreed with Ms Bryan. Gross holiday letting income of £148,000 had been assessed at £500 per week for 37 weeks - an occupancy rate of 71% - before deductions totalling 27% were made for overheads, largely as agreed with Ms Bryan. Mr Floyd’s occupancy rate of 71% was taken from the Wales Accommodation Occupancy Survey, 2013, but was the figure for the summer period rather than the whole year so overstated the income considerably.

66. In cross examination it was put to Mr Floyd that the GDV of the eight flats at £1,355,000 was equivalent to over £169,000 per flat, which would never have been achieved in the vacant possession market, where a figure of £60,000 - £70,000 was the typical price achievable at the valuation date for a one bedroom flat with a sea view. Mr Floyd eventually admitted that a lower price, of perhaps £85,000, would be achieved on a vacant possession sale but maintained that the basis was different for an investment sale.

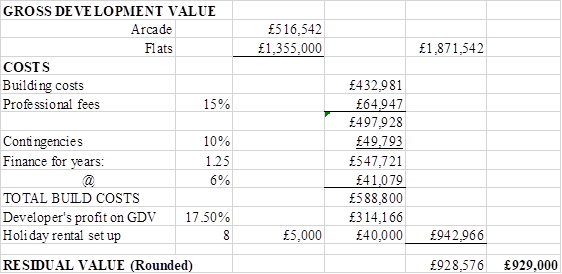

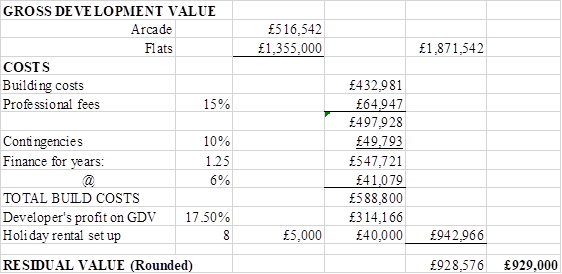

67. Mr Floyd adopted Mr Owen’s assessment of the costs of refurbishment at £432,981 and his residual valuation was as follows:

68. In an alternative approach, Mr Floyd used the comparative method to value the property as a cleared site based on evidence of the respondent’s purchase of the ground floor of neighbouring 24 (2,906 sq ft) in December 2011 for £240,000 or £82.58 for/sq ft. Mr Floyd scaled off from the Lawray drawings to assess a site area for the property of 3,632 sq ft and a value of £299,931, rounded to £300,000.

Evidence for the respondent

69. Ms Lisa Bryan MRICS has 20 years’ professional practice experience and is a Principal Surveyor in the Transport and Infrastructure Sector of the DVS based in Swansea. She was instructed to assess the market value of the property as at the valuation date for compulsory purchase compensation. Ms Bryan produced reports dated 2 October 2020, 20 November 2020 and 19 January 2021. She agreed a joint statement with Mr Floyd dated 15 January 2021.

70. Ms Bryan’s opinion of market value was stated to be £60,000 being the average of £57,050 and £69,000 (£63,025) from which was deducted 5.75% for investor’s costs. The first figure of £57,050 was derived from £815,000 per acre (an average of three transactions at £1,547,412/acre, £650,000/acre and £250,000/acre) applied to an area of 0.07 acres for the property site. In oral evidence Ms Bryan confirmed that her measurement of the site area at 0.07 acres (283.29 sq m), using a digital mapping tool, had produced an area smaller than the agreed ground floor area of the property at 308 sq m (0.076 acres) and should be amended to at least that figure.

71. Ms Bryan’s second figure of £69,000 was derived from applying £13/sq ft (the price paid by the respondent to buy the Honey Club) to 7,771.53 sq ft (722 sq m, being the estimated GIA of the property without the new third floor) to get £101,000. A deduction of £32,000 was then made for demolition costs, based on a figure supplied by Mr Jones.

72. Although she relied on the comparative method to get a positive value for the property, Ms Bryan produced no fewer than six iterations of a calculation using the residual method, all of which produced a negative outcome. The six iterations were used to test sensitivity to three different inputs, each of which was run assuming either new build costs or refurbishment costs taken from Mr Jones’s report. In cross examination she confirmed that the figures were derived from a development appraisal tool used in her work, and that behind the three page summary for each of her six assessments lay 12 pages of inputs, not provided in evidence.

73. We note that the development appraisal tool was designed for use in residential property development schemes and was overly sophisticated for the purpose of this case, leaving much of the essential detail obscured from view. In essence, however, the components were the same as those used by Mr Floyd, starting with an assessment of the GDV derived from the investment value of the ground floor, let as an amusement arcade and food kiosk, and the investment value of eight one-bedroom holiday apartments on the upper floors.

74. In oral evidence Ms Bryan amended her opinion of the ground floor rental value to £12.50/sq ft, based on the letting of an amusement arcade in Wrexham in November 2011 for £14.15/sq ft, adjusted down to reflect the larger size of the property and the downward movement of the market after that date. The overall rental value was assessed at £38,350 per annum. After deducting a management charge of 10% and applying a yield of 13%, based on evidence from a sale of 1 - 4 East Parade, Rhyl in October 2011, Ms Bryan assessed an investment value for the ground floor of £265,500.

75. The GDV of the eight holiday apartments was assessed by Ms Bryan using a nightly rate of either £75 or £50 (£525 per week or £350 per week) assuming (in her final report) an annual average occupancy rate of 51%, equivalent to 26.52 lettable weeks. The occupancy rate was an average derived from six tables of occupancy data for self-catering accommodation in North Wales and in coastal locations published in the Wales Accommodation Occupancy Survey, 2013.

76. Deductions totalling 26.5% for overheads had largely been agreed with Mr Floyd, giving a net income of £54,578 (at £50/night) or £81,867 (at £75/night). The investment yield of 8% had been agreed with Mr Floyd, resulting in a GDV for the holiday apartments of £682,227 or £974,610.

77. Ms Bryan adopted Mr Jones’s alternative assessment of the costs of refurbishment and conversion at £1,529,057, or demolition and reinstatement at £1,543,030, both of which figures far outweighed even the most optimistic GDV and produced a negative outcome.

Discussion

78. Although much time was spent in evidence discussing aspects of the respective residual valuations, in particular assumptions as to costs, there was evidence of a good number of transactions of commercial and development property, and also of flats in Rhyl. We shall return to some of these.

79. We acknowledge that the residual method is a useful tool to assess the viability of proposed development, and that this type of appraisal will be used by developers in deciding what they can afford to offer to pay for a site with development potential. We were referred to the RICS Valuation Information Paper No. 12 on the valuation of development land, effective from 1 March 2008, which reviews the pros and cons of valuing sites with development potential using both the comparative and residual methods. In practice, the comparative method is also a key component of the residual method in terms of assessing the GDV of a development.

80. In this case, unlike many, there were no uncertainties about the nature of the finished development and we start by addressing the evidence we heard on the GDV for each component of the finished development. The investment value of the amusement arcade with food kiosk was assessed by Mr Floyd at £516,542 or £168.36/sq ft. Ms Bryan’s figure was £265,500 or £86,54/sq ft. The difference between the figures arises partly from different rents of £17.21/sq ft and £12.50/sq ft respectively and partly from the use of yields of 9.2% and 13% respectively.

81. Mr Floyd had amended his view of rental value of the ground floor in his last report, increasing it from £45,000 to £52,800 by making a significant subjective adjustment to evidence of the passing rent for a two-storey property with a ground floor area only a quarter of the size of the property. His original figure of £45,000 was in line with the offer made by Dr Reddy, which we consider to be a generous figure of little weight since it did not result in a transaction. Ms Bryan’s revised rent of £12.50 was based on downward adjustment of 11.6% to an amusement arcade letting at £14.15 in Wrexham in late 2011, similar in general scale to the property.

82. We use the Wrexham transaction, as the best available and adjust downwards by 10% to a figure of £12.75 and a rent for the property of £39,000 after rounding. Deducting 10% for management and applying a yield of 11% (from evidence) we assess a GDV for the ground floor of £319,000.

83. Turning to the GDV of the holiday lets we note the evidence of sale prices for single holiday flats in Rhyl and comment that even Ms Bryan’s lowest figure, based on £50 per night, gave a GDV of £85,278 per flat, which is at the upper end of sales evidence and a figure accepted by Mr Floyd as a realistic price for disposal with vacant possession. This must be the ceiling of value for these flats since any investor and lender would need to have in mind their base value for disposal. We assess a value of £85,000 per flat or £680,000 as the GDV of the holiday lets.

84. The total GDV of the development is therefore assessed, on rounding, at £1,000,000. Using our assessment of the build cost at £864,000, and working through the further deductions for professional fees, contingencies, finance, developer’s profit and holiday rental set up we achieve a negative outcome of around -£283,000.

85. In other words, the development in line with the planning consent was not viable at the valuation date. But that does not mean that it would have remained unviable, and it does not mean that the property had no value at that date. It clearly offered potential for future development and the market would have recognised the benefit of the ongoing regeneration of Rhyl and its sea frontage. Dr Reddy’s offer is some evidence of this, although we attach little weight to the figure he offered given that it was the only offer received by the claimants

86. We turn now to the limited available transaction evidence of sites with development potential, but give no weight to the widely divergent evidence analysed by Ms Bryan on an acreage basis.

87. Mr Floyd, in his fall-back valuation, relied on the price of £240,000 paid by the respondent for the ground floor of 24, two years before the valuation date. He analysed the price at £82.58/sq ft using the ground floor area of 2,906 sq ft, which Ms Bryan had disputed because there may have been a usable basement area to take into account. We heard evidence about the nature of the former basement under that property, which suggested to us that there was no area worthy of inclusion in the analysis of the price. However, we heard evidence from Mr Thomas, who negotiated the purchase, that it was made following reports on the unsound state of the structure above it, previously acquired by the respondent as part of the Honey Club. The implication was that this had been an expedient price, possibly even a ransom price, and it had not been not tested in the market.

88. By contrast, the respondent’s purchase of the dilapidated Honey Club for £249,995 in December 2010 followed extensive exposure to the market and a guide price reduction from £700,000 in 2009 to £200,000 - £300,000 in late 2010. The auction particulars stated that the total area over three floors was 18,644 sq ft so the price analyses to £13.41/sq ft. This price, applied to the floor area of the property at the valuation date, assessed by Ms Bryan to be 7,771 sq ft, would give a figure of £104,209, say £105,000. A higher price per square foot would be likely for a property less than half the size of the Honey Club, so we consider this to be below the value for the property as a similar redevelopment proposition. We see no reason to make a deduction for demolition as Ms Bryan did (the Honey Club also required to be demolished).

89. An important difference between the property and the Honey Club for the purpose of this valuation is the assumption of an extant planning permission, giving certainty of redevelopment prospects. Properties with development potential, but without planning permission, are viewed in the market with great caution and significant discounts will be applied for the risk and uncertainty involved in gaining a valuable planning consent. Such a discount can, to some degree, be added back here to reflect the certainty of the planning permission, albeit one which was not viable at the valuation date.

90. We therefore consider that the market value of the property as a smaller scale redevelopment proposition, with planning permission, is higher than the figure of £105,000 assessed by analysis of the Honey Club sale. But the uplift would be tempered by the uncertain future viability of the permission. Reflecting those considerations, we increase the figure by one third, to determine a market value for compensation of £140,000.

Disposal

91. The compensation payable by the respondent for the compulsory acquisition of the property is £140,000. The claimant is also entitled to a basic loss payment which is agreed to be £10,500. Reference is made in Mr Floyd’s report of 15 January 2021 to claims for an alternative premises survey fee of £2,000, and conveyancing costs of 2.5%. No evidence of those costs being incurred was provided, nor of any expectation that they would be incurred, and we infer that they are notional figures. There is therefore no basis on which they can be awarded as additional compensation.

92. This decision is otherwise final on all matters other than the cost of the reference. Any application for costs should be made in accordance with rule 10(10) of the Tribunal’s Procedure Rules.

Martin Rodger QC Diane Martin MRICS, FAAV

Deputy Chamber President Member

12 March 2021